Looking for a no-annual-fee card that still delivers cashback, travel perks, and complete app control? Inter’s lineup pairs a free digital account with credit cards designed for different spending habits.

This guide helps match your profile to the right tier and shows the fastest way to apply inside the Super App.

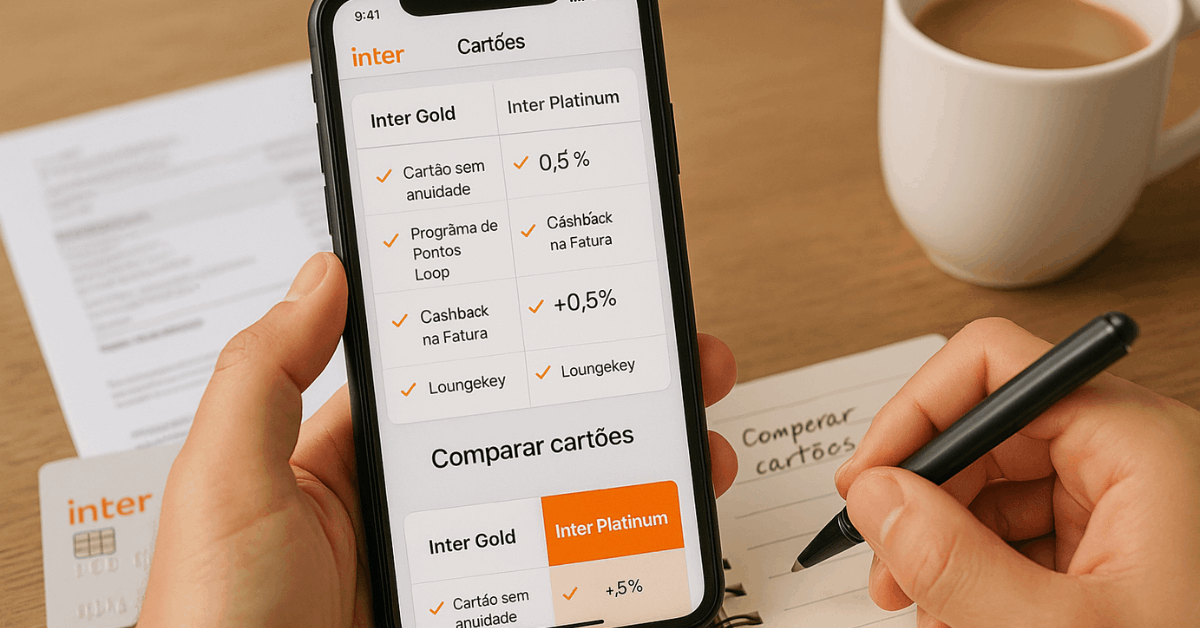

Inter Cards: Which Tier Fits Your Profile

Picking a tier that suits real spending patterns prevents leaving value on the table. Scan the snapshot below to align benefits with your usage and income profile.

| Tier | Best For | Rewards Baseline | Key Perks | Access |

| Gold | Everyday spending and first card | 1 Loop point per R$10 | No annual fee, global acceptance, contactless, Super App features | No stated income minimum; profile analysis applies |

| Platinum / Prime | Frequent flyers and higher activity | 1 Loop point per R$10 | Priority service, higher limits, lounge access, travel cover (Prime), premium app support | Stronger credit profile typically required |

| Win | High-income, heavy spenders | Enhanced redemption rates | Concierge, VIP support, broader lounge access, boosted cashback | Invitation-only; limited availability |

Some materials cite “Black” when referring to a premium tier; Inter’s Prime and Win occupy that space in current messaging.

Inter Loop Rewards: Points, Cashback, and Where to Use Them

Redeeming rewards should feel practical, not complicated. Loop points convert to outcomes that reduce real costs and support travel goals.

- Earning rate and rules: Every R$10 in eligible credit spend earns 1 Loop point, credited to your rewards balance. In some instances, maintaining Débito Automático de fatura (automatic bill debit) is required to keep earning.

- Redemption paths: Points convert to cashback deposited in your account, miles for trips, dollars in the Global Account, and investments via Meu Porquinho, along with VIP lounge access, Inter Shop discounts, or bill credits.

- Tracking and timing: The Super App shows accruals, pending amounts, and redemption history to keep rewards usage transparent.

Why Banco Inter Cards Stand Out

Cost control and convenience matter more than flashy extras. Inter removes the annual fee across all tiers, including Platinum/Prime, while keeping international acceptance on the Mastercard network.

Contactless payments, virtual cards, and split purchases in up to eight installments create flexibility during tight months.

Super App management centralizes spending categories, early installment payoff, and real-time alerts, reducing friction during travel and online shopping.

Eligibility and Documents: Who Can Apply

Basic criteria focus on identity, residency, and credit hygiene.

Applicants must be at least 18 years old, hold a valid CPF and proof of Brazilian residency, maintain an active Banco Inter digital account, and avoid serious negative records at bureaus such as Serasa or Boa Vista.

A clean profile increases approval odds and supports higher starting limits.

Apply in the App: Fast, Clean, and Fully Digital

Approval flows more smoothly when steps are completed in one session. Follow the sequence below inside the Super App to minimize back-and-forth.

- Create or access your digital account: Download Inter on Android or iOS, register, and finish identity verification in-app.

- Enter the Cartões menu and start the request: Tap Cartões and select Solicitar Cartão de Crédito to open the application form.

- Provide complete personal and income data: Confirm identity details and submit income information clearly and accurately.

- Send for analysis and track status: Submit the form, enable push notifications, and monitor updates in the app.

- Activate your virtual card or await delivery: Use the virtual card immediately after approval while the physical card ships.

Build and Grow Your Limit Without Paperwork

Securing a usable limit early helps avoid carrying other cards. Inter links investments to credit via Poupança Mais Limite and CDB Mais Limite, instantly converting deposited amounts into available limit.

This secured approach supports applicants with limited income documentation, improves internal scoring over time, and can be adjusted directly in the Super App without branch visits.

Fees, Interest, and Exchange Costs to Watch

Carrying a balance raises total cost quickly, so rate awareness is essential. Rotative credit typically ranges around 7.7%–8.5% per month, varying by profile and usage.

Late payment triggers a 2% fine on the overdue amount plus daily interest, while installment purchases may include fixed fees tied to term length.

Foreign transactions follow the Mastercard rate plus Inter’s spread (often cited near ~4%) and may show an additional ~1.1% network or service component depending on transaction type. Exact values appear in the app and can differ by customer.

International Use and Digital Wallets

Spending abroad should remain straightforward and secure.

The card runs on the Mastercard network worldwide, continues to earn Loop points on foreign purchases, and supports Google Pay, Apple Pay, Samsung Pay, and Pagamentos no WhatsApp.

Paying with a phone, watch, or bracelet reduces card-present risk and speeds checkout at transit hubs and busy stores.

Super App Advantages That Simplify Daily Use

Operational control drives most of the real value.

Virtual cards protect online purchases; spending can be organized by category or merchant; one-off purchases can be split into up to 8 installments, and early repayment of installments lowers accrued costs.

Salary portability, unlimited Pix transfers and withdrawals, bill payment, check or boleto deposits, in-app shopping, and Open Finance account linking round out the daily toolkit, all without a monthly maintenance fee.

Security and Official Support Channels

Questions and incidents deserve fast, safe resolution. Use the controls and contacts below to stay protected and get help quickly.

- Real-time security controls: Biometric login, two-step verification, instant freeze/unfreeze, and granular usage limits are available in-app.

- Disposable virtual cards: Single-use numbers reduce exposure during purchases at unfamiliar sites or merchants.

- Fraud monitoring and alerts: Transaction notifications and encryption-backed checks flag unusual activity early.

- Official contact numbers: 3003 4070 (capitals and metro), 0800 940 0007 (other regions), SAC 0800 940 9999, Ouvidoria 0800 940 7772, and [email protected] for legal or administrative correspondence.

- Safety reminder: Inter will not request passwords or transaction codes by phone; initiate calls to the numbers above when support is needed.

Everyday Actions in the App

Routine tasks sit under Cartões and related menus for quick access.

Request an additional card, generate a second copy, track shipping status, activate the virtual card, enable NFC for contactless, authorize international and online purchases, ask for a limit increase, pay the statement, anticipate installments, and, when necessary, split the statement inside the Super App.

Processing times, limit release after payment, and feature availability depend on profile and system confirmation.

Choosing the Right Inter Card for Your Profile

Matching benefits to behavior leads to higher real-world value.

Gold covers daily spending with no annual fee; Platinum/Prime suits travelers who want lounges and priority service; Win targets heavy spenders who need concierge support and enhanced redemptions.

App-first control, transparent fees, and a practical rewards path make the lineup a strong fit for cost-conscious users seeking modern payment tools.

Compliance Note and Final Check

Information such as rates, eligibility, and perks can change and may vary by profile. Confirm current terms in the Super App or on Inter’s official site before applying; approval remains subject to internal credit analysis and risk policies.

Ready to proceed? Open the Inter app, submit a single clean application, and activate the virtual card for immediate use once approved.

Conclusion

Inter’s no-fee tiers combine cashback, travel perks, and full app control so everyday spending stays efficient and secure.

If you value quick setup, open the digital account, apply in the Cartões menu, and activate the virtual card after approval to start earning immediately.

Ready to move, select the tier that fits your usage and turn Loop rewards and Super App tools into consistent savings.